Opinion of Value

Understand Your Business’ Worth

An Opinion of Value is a professional assessment of a company’s market worth. It evaluates the financial health of the business, considering key factors such as revenue, assets, liabilities, and market trends. This analysis can be crucial for mergers, acquisitions, investor negotiations, or internal evaluations. An opinion of value report is a streamlined version of a full business valuation, providing a snapshot of the business's worth.

Mikel Consulting's Record of Success

-

4,000+

Business Plans

-

$1.6B+

Funding Secured

-

97%

Success Rate

-

100+

Trusted Partners

-

90+

Client Countries

Opinion of Value

Mikel Consulting offers expert financial analysis, using industry benchmarks and customized approaches to provide a detailed opinion of value report. We analyze key financial metrics, industry trends, and operational data to give you an accurate evaluation of your business's current and potential value. Our team ensures that your assessment is both data-driven and actionable. You might need an opinion of value for several reasons, including selling your business, raising investment capital, planning for future growth, or navigating through a merger or acquisition. It’s also valuable for internal decision-making, helping to ensure that your business is on track for long-term success.

Key factors include revenue, profitability, market position, industry growth rates, assets, liabilities, and external market conditions. Intangible assets like brand reputation, intellectual property, and customer loyalty can also significantly impact the overall valuation.

Why Choose Mikel Consulting?

-

PROVEN EXPERTISE

Experience: Prepared 4,000+ customized business plans since inception.

Success Rate: 97% success rate for 3,000+ valued clients worldwide.

Trustworthy Team: Dedicated professionals with 24 years of industry experience.

-

TIME SAVINGS

Efficient Process: Prompt delivery of first drafts within 7-10 business days.

Focus on Growth: Save weeks of work to concentrate 100% on growing your business.

Industry Research: Powered by direct research and hundreds of top industry resources.

-

HIGHLY CUSTOMIZED

Custom Solutions: 1-on-1 consultations to understand your business, industry, and goals.

Reflect Your Vision: Create a custom-tailored business plan to best represent your vision.

Maximize Success: Designed to attract funding, increase potential for success, and stand out from the competition.

-

$1,250

Starting Price (USD)

-

7 Days

Delivery Timeframe

-

1 Hour

Phone Consultation

-

2

Revisions

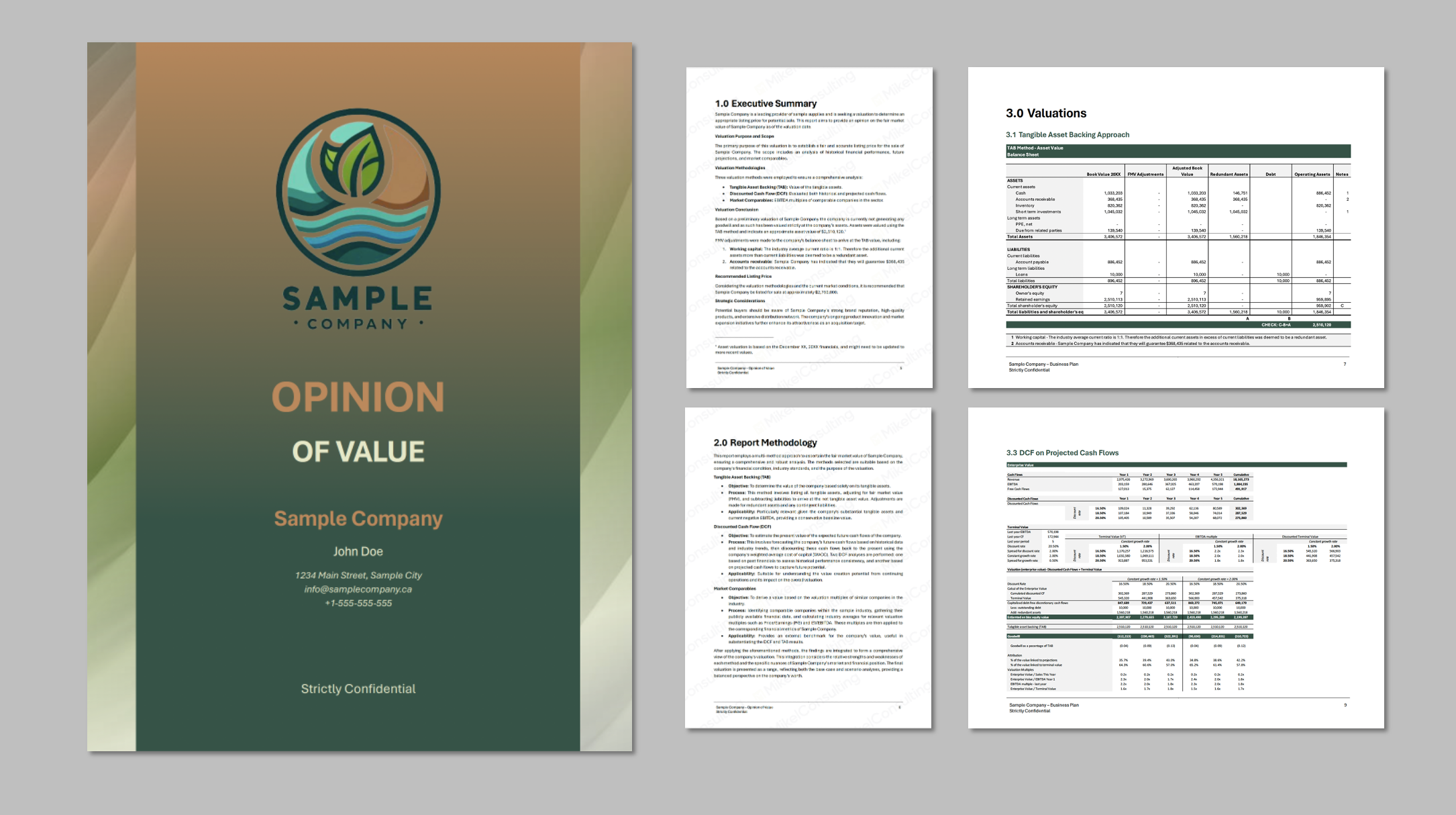

Opinion of Value Example

What’s Included

-

Overview of the valuation purpose and scope.

-

Detailed explanation of the methods used (Tangible Asset Backing, Discounted Cash Flow, Market Comparables).

-

Valuing the company based on its tangible assets, adjusted for fair market value and liabilities.

-

Estimating the present value of expected future cash flows using historical data and financial projections.

-

Comparing valuation multiples from similar companies in the industry to provide an external benchmark.

-

Integrated findings and recommended listing price.

FAQs

-

Our Opinion of Value report utilizes three primary valuation methods to provide a comprehensive and balanced assessment of your company's worth.

Tangible Asset Backing (TAB)

Objective: Determines the value based on the company's tangible assets.

Process: Lists all tangible assets, adjusts for fair market value, and subtracts liabilities to arrive at the net tangible asset value.

Use: Particularly relevant for companies with significant tangible assets and current negative EBITDA, providing a conservative baseline value.

Discounted Cash Flow (DCF)

Objective: Estimates the present value of the expected future cash flows.

Process: Forecasts future cash flows based on historical data and industry trends, then discounts these cash flows back to the present using the company's weighted average cost of capital (WACC). Two DCF analyses are performed:

Use: Suitable for understanding the value creation potential from ongoing operations.

Market Comparables

Objective: Derives a value based on the valuation multiples of similar companies in the industry.

Process: Identifies comparable companies, gathers their financial data, and calculates industry averages for relevant valuation multiples such as Price/Earnings (P/E) and EV/EBITDA. These multiples are then applied to the corresponding financial metrics of your company.

Use: Provides an external benchmark for your company’s value, supporting and substantiating the findings from the DCF and TAB methods.

-

An Opinion of Value provides a reliable estimate of your company's worth, which is essential for making informed financial decisions. It helps in setting a fair price if you are planning to sell your business, attracts potential investors by showcasing your company’s value, and supports strategic planning and decision-making. Additionally, it can be crucial for legal and regulatory compliance, ensuring that your company meets necessary standards for financial reporting and other requirements.

-

An Opinion of Value is essential for:

Strategic Planning: Helps in making informed decisions about the future direction of the business.

Securing Financing: Investors and lenders often require a reliable valuation to provide funding.

Mergers and Acquisitions: Accurate valuations are crucial for negotiations during sales, mergers, or acquisitions.

Growth Planning: Understanding your business's worth aids in effective financial planning and growth strategies.

-

There are several risks to consider, including:

Market Fluctuations: Economic conditions and market trends can change, potentially impacting the accuracy of the valuation.

Data Accuracy: The valuation is based on the data provided. Inaccurate or incomplete information can lead to a misleading valuation.

Assumptions: Valuations involve assumptions about future performance, which may not hold true. Changes in the business environment or internal operations can affect these assumptions.

Regulatory Changes: New regulations or changes in existing laws can impact the valuation by altering market conditions or operational costs.

-

IThe accuracy of the Opinion of Value depends on the quality and completeness of the information provided. Our experienced valuation professionals use industry-standard methodologies and cross-check results using multiple approaches to ensure a reliable and thorough valuation.

-

Speak With An Advisor

We can’t wait to get you funded!

-

Learn About Our Partner Program

Partners enjoy added benefits including favourable pricing!

We have the expertise to unlock opportunities for your business growth, funding, and immigration success through our tailored business plans and strategic guidance.

© 2024 Mikel Consulting All Rights Reserved