Crafting a Winning Pitch Deck: 11 Essential Slides for Investors

Navigating the competitive landscape of Canadian investment requires not just a great business idea, but also an exceptional way to present it. At Mikel Consulting, we understand the nuances of what makes a pitch deck resonate with investors. Whether you are a start-up seeking seed funding or an established company looking to expand, your pitch deck is often your first and most impactful touchpoint with potential investors.

In this blog post, we’ll guide you through the process of crafting a pitch deck that not only communicates the essence and potential of your business but does so in a manner that aligns with the expectations and investment criteria of Canadian financiers. From capturing the investor's interest with a strong initial hook to laying down a clear and persuasive financial roadmap, each slide of your pitch deck plays a crucial role in your funding journey.

Drawing on our extensive experience and a proven track record of securing $1.6 billion in funding for our clients, we have simplified what makes a pitch deck successful into 11 key slides. This guide will provide strategic insights to develop each slide, ensuring your presentation is both compelling and effective.

Slide 1: Introduce the Company

The opening slide of your pitch deck, where you introduce your company, is pivotal for making a strong first impression. It should succinctly present your business, establishing your brand identity immediately. Start with your company name and logo to set a visual tone. Include a concise mission statement to encapsulate your business’s core purpose and strategic goals. Briefly mention the founding date and location to provide historical context. Clearly explain what your company does, ideally in a simple tagline or a one-sentence overview.

Expert Tip

Ensure this slide is visually clean and professionally designed to communicate your company's identity effectively in less than 30 seconds.

Slide 2: Problem Definition & Company Solution

This slide is crucial as it clearly defines the market problem your company addresses and immediately presents your solution, illustrating your business’s relevance and necessity. This dual-presentation not only highlights the issue but showcases your proactive approach to solving it.

Defining the Problem

Start by outlining a broad yet significant problem that your target audience faces. This could be a gap in the market, an unmet need, or an inefficient process that your business aims to improve. Use data or market research to support the existence and scale of this problem, establishing a solid foundation for your solution’s impact.

Presenting the Solution

Follow the problem statement with your solution. Describe how your product or service resolves the identified issue, emphasizing its uniqueness and the value it adds. Highlight key features or methodologies that differentiate your solution from competitors. This is the point to showcase your innovation and the specific benefits your solution offers.

Expert Tip

Incorporate visuals like diagrams or simple flowcharts that contrasts the problem with your solution, making the connection intuitive and immediate. This visual pairing helps in reinforcing the message and making the slide more engaging and memorable.

Expert Tip

This slide should be crafted to not only explain what your company does but to resonate emotionally with the audience, showing that your business is not just viable but essential in the current market landscape.

Slide 3: Why Invest Now

This slide is pivotal in your pitch deck as it captures the strategic timing for investment based on current market trends and growth potential. It is designed to convince investors that now is the prime time to invest, leveraging the momentum of market dynamics.

Highlighting Market Trends

Start by detailing significant trends in the market that support your business model. These might include technological advancements, consumer behavior shifts, regulatory changes, or macroeconomic factors driving demand for your product or service. Clearly link these trends to how your company is positioned to capitalize on them.

Demonstrating Growth Potential

Discuss the growth trajectory of your market segment. Use data to show past growth and project future expansion. Explain how your company is set to grow within this rising market. Illustrate this with graphs or charts that depict growth trends and your company’s performance metrics relative to these trends.

Timeliness of the Investment

Explain why the current market conditions make this the perfect time to invest. Perhaps your sector is at an inflection point, or your company has just reached a milestone that predicts accelerated growth (like a new product launch or entry into a new market).

Expert Tip

Emphasize how the identified trends not only favor your business model but are also expected to continue or evolve in a way that benefits your company long-term. This demonstrates foresight and strategic planning, enhancing investor confidence.

Slide 4: Market Potential with TAM, SAM, SOM

This slide is crucial as it quantifies the opportunity ahead and demonstrates the scalability and potential reach of your business. By defining the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM), you provide investors with a clear picture of the market you aim to capture.

Total Addressable Market (TAM)

Start by identifying the TAM for your product or service, which represents the entire global demand if 100% market share were achieved. This figure sets the upper bounds of potential market size and helps investors understand the ultimate potential of the market.

Serviceable Available Market (SAM)

Narrow down to the SAM, which is the segment of the TAM targeted within your geographical reach and with your current business model. This is the market you can actually serve with your offerings and provides a more realistic assessment of your target market size.

Serviceable Obtainable Market (SOM)

Finally, estimate the SOM, which is the portion of the SAM that you can capture. This considers your current resources, competition, and market penetration strategies. It's your realistic market capture in the short to medium term and is critical for setting initial sales targets and growth expectations.

Expert Tips

Use graphs or pie charts to visually represent these market segments. This visual comparison can help illustrate the relationship between TAM, SAM, and SOM, making it easier for investors to grasp the different layers of market potential.

Also when presenting TAM, SAM, and SOM, ensure the data is backed by credible sources and realistic assumptions. This enhances your credibility and shows that your market understanding is grounded in thorough research.

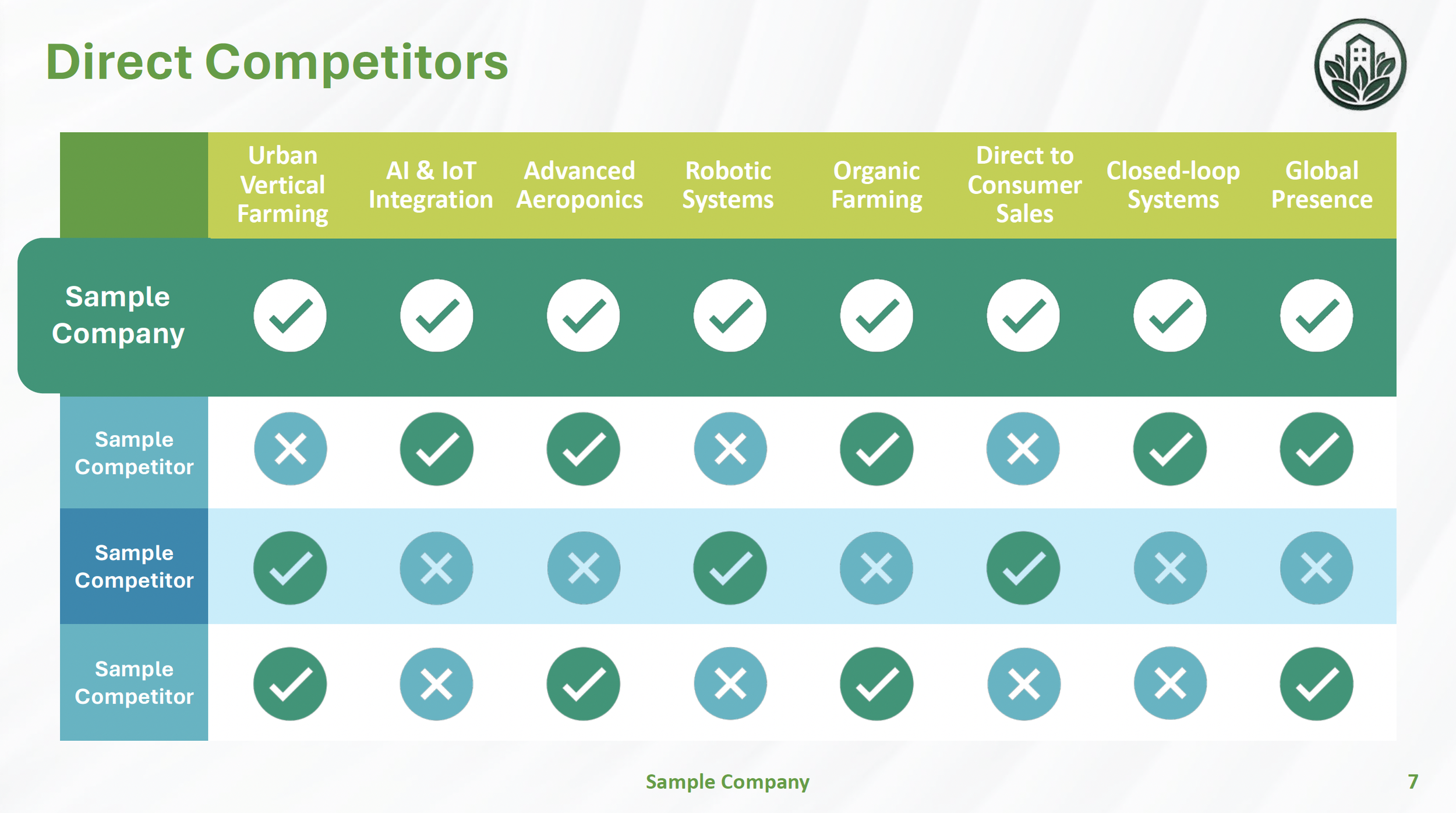

Slide 5: Competitive Analysis

This slide assesses your position within the competitive landscape, demonstrating how your company compares to others in the industry. Begin by outlining key competitors, both direct and indirect, to provide context for your market placement. Highlight your company’s competitive positioning by detailing aspects like technological innovation, superior customer service, unique pricing strategies, or product quality that set you apart.

Expert Tip

Maintain an objective tone and back your analysis with up-to-date credible sources (e.g, competitors websites). This not only strengthens the credibility of your analysis but also ensures that investors have confidence in the accuracy of your competitive evaluation.

Slide 6: Competitive Advantages

This slide presents the unique strengths that differentiate your company from competitors, providing clear reasons why it stands out in the marketplace. Key competitive advantages include technological leadership, which leverages cutting-edge innovations to surpass industry standards; regulatory mastery, emphasizing your ability to efficiently navigate complex legal landscapes; strategic alliances, which extend your reach and enhance your offerings through partnerships with industry leaders; and customization capabilities, showcasing your flexibility to tailor solutions directly to customer needs. Each of these strengths contributes to your company’s unique position in the industry, making it an attractive option for investors looking for reliability and forward-thinking in their portfolio.

Expert Tip

Focus on delivering a clear narrative around each competitive advantage. It's not just about stating what the advantages are but also explaining why they matter. Connect each advantage back to how it impacts your customer's experience or your operational efficiency to ensure investors can see the practical benefits and real-world applications of these strengths.

Slide 7: Business Model

This slide outlines how your company generates revenue, detailing your primary revenue streams, such as product sales, subscription services, or licensing. Explain your cost structure and how economies of scale play into your profitability. Highlight any unique aspects of your business model, such as innovative pricing strategies or unique distribution methods, and discuss key partnerships that enhance operations and revenue growth. Emphasize the scalability and adaptability of your model to reassure investors of its potential to expand and thrive in changing markets.

Expert Tip

Ensure clarity and simplicity when explaining your revenue streams. This slide is essential for making investors understand how your business makes money, focusing on straightforward language and clear visuals to communicate the financial fundamentals effectively.

Slide 8: Go-to-Market Strategy

This slide outlines your strategic objectives and go-to-market strategy, including a clear timeline for achieving key milestones. Begin by presenting your primary business goals, such as market penetration, customer acquisition, or product expansion. Describe your approach to reaching target customers through marketing channels, sales strategies, and partnerships. Highlight specific milestones over the next 6, 12, or 24 months to show a structured timeline for implementation. Emphasize any unique tactics or differentiators that will support your success, like leveraging technology or entering new markets.

Expert Tip

A defined timeline builds confidence by showing investors that your strategy has actionable, time-bound steps. This timeline should reflect realistic milestones that demonstrate steady progress toward your goals.

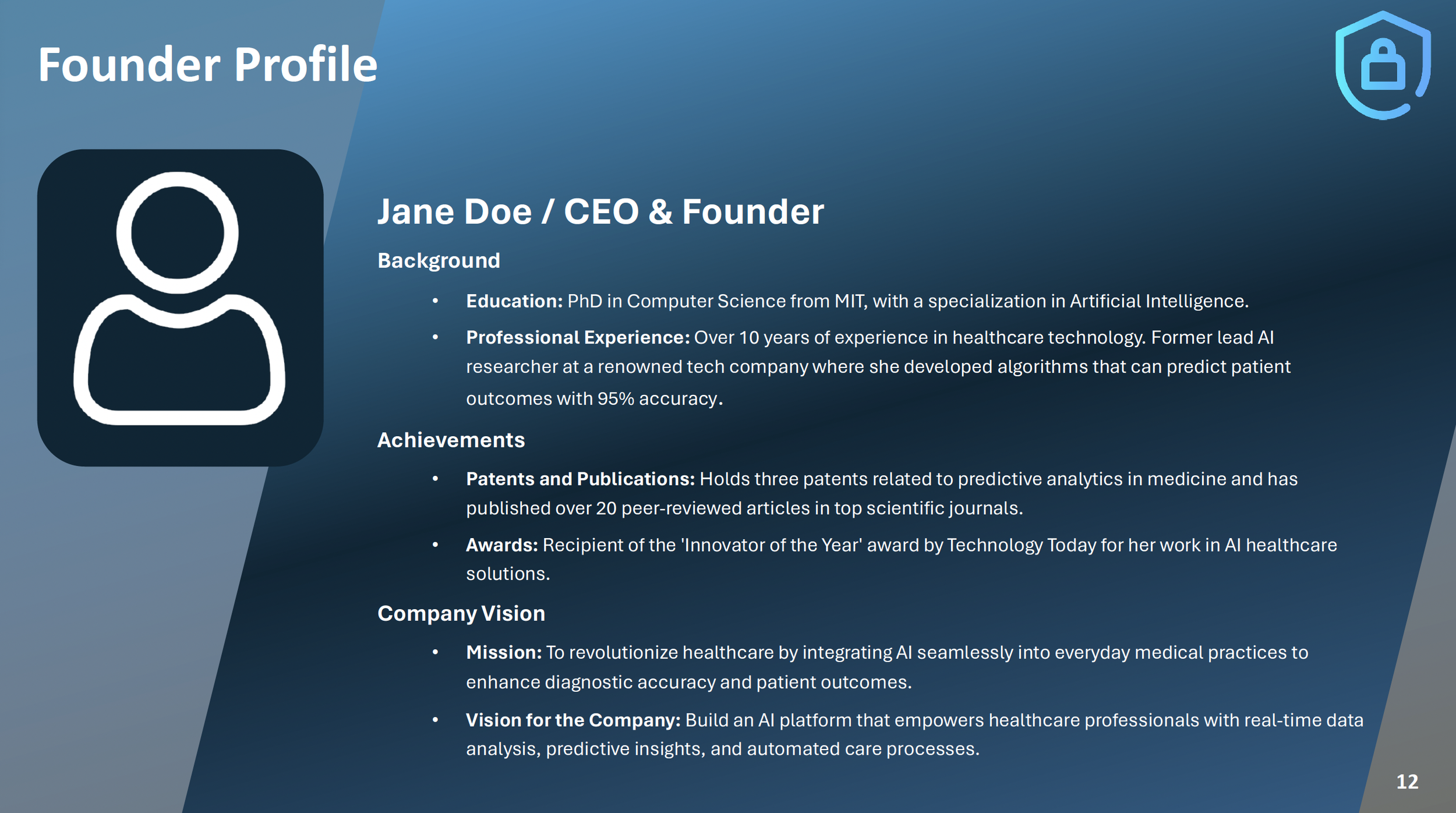

Slide 9: Management Team

This slide introduces the key member(s) of your management team, showcasing the expertise and leadership driving your company's success. Briefly highlight each team member's relevant experience, skills, and past achievements that directly support your business goals. Emphasize any industry-specific expertise, prior successes, or unique skills that make your team uniquely qualified to execute your strategy and achieve growth. Investors should leave this slide with confidence in your team’s ability to navigate challenges and drive the company forward.

Expert Tip

Highlight how your team(s) collective experience aligns with the company’s goals and market demands. Investors value a team that not only has relevant expertise but also a proven track record in areas critical to achieving your business’s vision.

Slide 10: Funding Ask and Use of Funds

This slide outlines the specifics of your funding needs, providing investors with a clear understanding of the investment opportunity. Start by stating the funding round (e.g., Seed, Series A) and the exact amount you’re seeking. Include the target close date to establish a timeline for the round, as well as the pre-money and post-money valuations to clarify your company's valuation. Then, break down the use of funds across key categories, such as product development, marketing, hiring, or operational expansion. This level of detail shows investors that you have a strategic plan for capital allocation that aligns with growth goals and measurable milestones.

Expert Tip

Provide clear and specific details on the funding structure, including valuation and allocation. Investors appreciate transparency, as it demonstrates that you have a well-defined financial roadmap for growth.

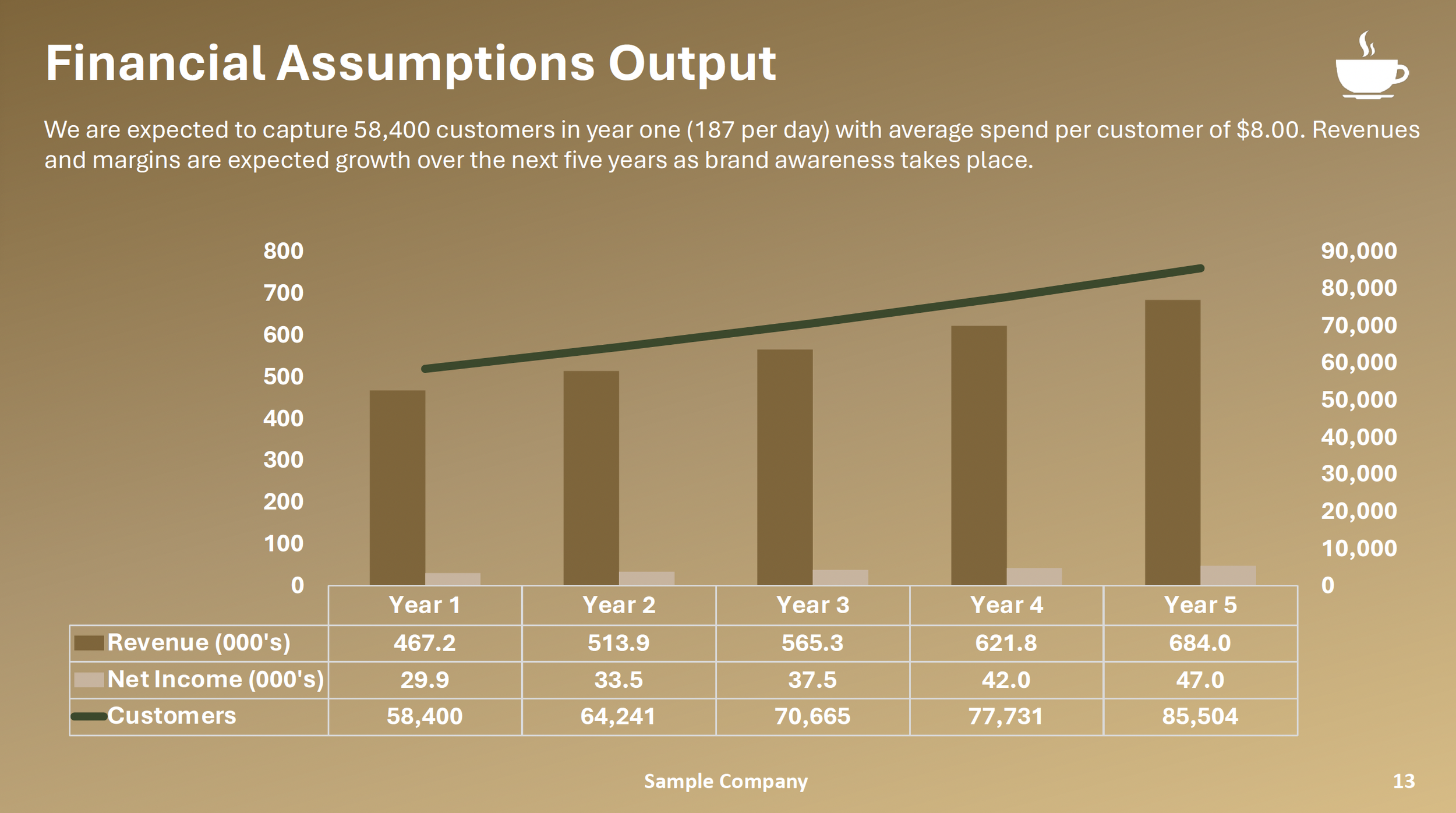

Slide 11: Financial Highlights/Projections

This final slide presents the key financial metrics and projections that illustrate your company’s growth potential and profitability. Highlight essential figures such as revenue forecasts, profit margins, and EBITDA over the next 3-5 years. Use visuals like charts or graphs to make the projections clear and accessible. This slide should give investors a snapshot of your company’s financial health and future potential.

Expert Tip

Keep financial projections realistic. Investors look for well-grounded forecasts that reflect a balance between ambition and feasibility, providing confidence in your financial strategy.

Key Takeaways

Creating a compelling pitch deck is an essential step in securing investment, as it serves as the foundation for presenting your business’s potential to investors. Each slide plays a crucial role in telling your company’s story, from defining the problem you solve and highlighting your competitive advantages to outlining your financial projections. At Mikel Consulting, we understand the importance of clarity, strategy, and data in crafting a pitch deck that resonates with investors.

By following these 11 essential slides, you’ll be able to showcase not only the vision and value of your company but also the strategic path you’ll take to achieve growth and profitability. Remember, the goal is to create a pitch deck that is not just informative but also engaging and memorable. When done right, your pitch deck will serve as a powerful tool to open doors, build investor confidence, and secure the funding necessary to propel your business forward.

Ready to make an impact? Contact Mikel Consulting now for assistance.